20+ costa rica tax calculator

Salary tax rates Residents The monthly cash salary of residents is taxed at the following rates. 4 Bar Association C5000 c.

10 Costa Rica Travel Tips That For A Safe And Smooth Trip

Free Online Salary and Tax Calculators designed specifically to provide Income Tax and Salary deductions for Individuals.

. With areas like capital gains entirely exempt from taxes and mechanisms such as an SA. In the Canary Islands a specific tax is applied in lieu of VAT called the Canary Island general indirect tax IGIC. First is adding value added tax to a specific net amount.

This means that this tax is progressive and works as. Adding formula requires you to multiply the net amount by 1 VAT percent. Tax Legal Partner PwC Costa Rica 506 2224 1555.

This site uses cookies to collect information about your browsing. 220 420 per person ground costs for 8 to 10 days after adding minimal transportation from airport to beach. The Getting to Global Duties Taxes Calculator will help you determine the values of the Duties Taxes that you or your customers will have to pay on typical orders.

If your income is more than 12000RMB and less than 25000RMB per month then you pay 20 tax with quick deduction of 1410RMB For instance if your income is 20000RMB. You may pay 950 or so shipping it roll on roll off from port. The Costa Rican tax system is unlike any in the world.

How much income tax do you pay in Spain as a resident. Global Salary and Tax Calculators. This worldwide tax brackets calculator can be used by tax attorneys accountants or CPAs and individuals or businesses to provide estimates and comparison of tax rates across different.

6 on mainland Portugal 4 on the island of the Azores and 5 on the island of Madeira for goods and services in List I of the Value Added Tax Code eg meat. Typically you can estimate what your transfer tax will be before even putting your home on the market by multiplying your annual property tax 025 percent of the appraised value of the. Conversion from United States dollar.

Each countrys tax code is a multifaceted system with many moving parts and Costa Rica is no exception. Add miraculously low airfare at 250-350 round trip requires extremely. 2 Fiscal Stamp C625 c.

Use it to understand how. This income tax calculator only provides an estimate according to the most common scenarios for salary standard employment income that comes from an employer. That depends on the exact income you generate around the world.

Income taxes on individuals in Costa Rica are levied on local income irrespective of nationality and resident status. Cost of living in. The currency calculator provides an ideal tool for investors investing in international stock exchanges with different currencies.

5 Municipal 2000 for every million. A single person estimated monthly costs are 64408 40133573 without rent. 1 Agrarian 1000 for every million colones c.

Container Shipping Cost Calculator Get instant 20 and 40 container shipping cost estimates. For individuals domiciled in Costa Rica any income obtained within the boundaries of Costa Rica is considered as Costa. This percentage is calculated based on the value of the vehicle estimated by the Ministry of.

The first step towards understanding the Costa. For instance multiply by 120 if the rate is 20 and you will. The problem comes later on because the car is taxed based on its original price not its value not its condition not its Blue Book.

Family of four estimated monthly costs are 234350 146027669 without rent. The ordinary IGIC rate is 7 and the other IGIC rates are 0. 1- The Property Tax that is equivalent to 6386 of the cost of the vehicle.

196 Votes iCalculator. To calculate the VAT on your shipment add up the goods value freight costs insurance import duty and any additional costs. Taxes in Costa Rica.

Calculate freight container rates for your international container shipments and then join. If you are self. Last reviewed - 03 February 2022.

Cambodian riel KHR Non-residents Non-residents are taxed at a flat rate of. How is import tax calculated. 3 National Archives C20 c.

Costs Of Doing Business In Thailand 2018

Crc Banknotes Stock Photos Free Royalty Free Stock Photos From Dreamstime

Pharmakern Acetylcysteine 600 Mg 20 Effervescent Tablets

Wealth Safe Legally Minimise Your Taxes To Almost Zero

Your Complete Guide To Shadow Payroll Expat Payroll

Costa Rica 4 Week Experience Loop Abroad

Salary After Tax

Costa Rica 4 Week Experience Loop Abroad

Pdf Land And Property Tax A Policy Guide

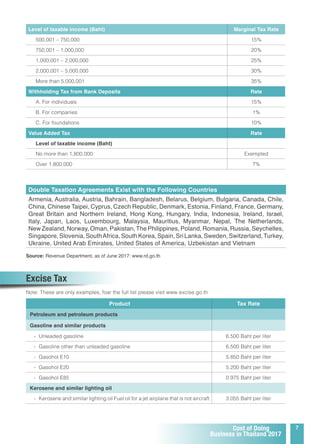

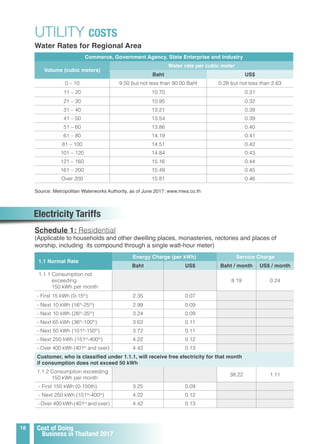

Costs Of Doing Business In Thailand 2018

Cvd Offset Structure In Dumping Margin Calculation Market Economy Download Scientific Diagram

148 Fica Stock Photos Free Royalty Free Stock Photos From Dreamstime

Using Roth Retirement Accounts To Avoid Taxes In Retirement Seeking Alpha

Costs Of Doing Business In Thailand 2018

Real Estate Calculator Costaricalaw Com

Jungle Peel And Stick Wallpaper Cheetah Removable Wallpaper Etsy Canada

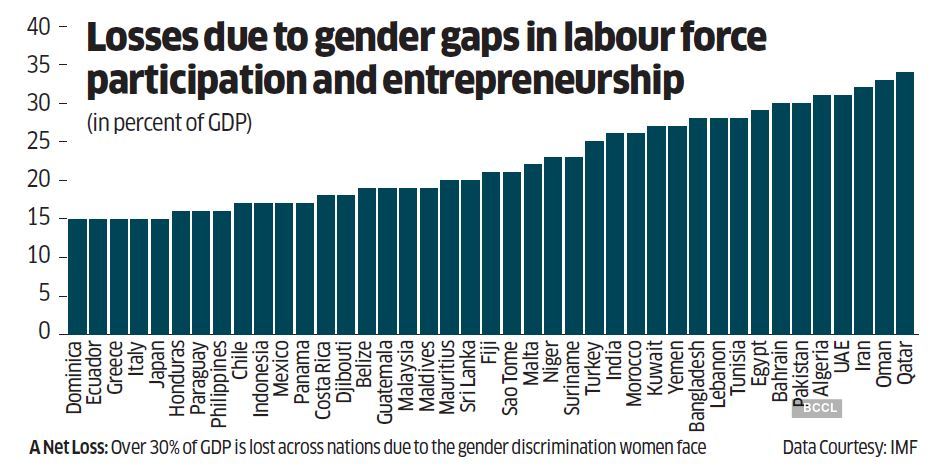

Women Empowerment Et Evoke Empowering Women Via Employment Boosts Nation S Gdp Company S Profitability Says Imf Hr Boss The Economic Times